Wealth Building. Wealth Preservation. Financial Independence. Antifragile.

Don’t let the Infinity symbol and the name Bank fool you. This IS NOT a life insurance scam. You can Be Your Own Banker without buying a life insurance from a snake oil salesman. Why there is so much of these scammers publishing videos on YouTube and books on Amazon. It’s not because they want to keep you informed?! It’s because the commissions are extremely generous for the seller. 50-100% commission for the first year premium and 2-10% for years to come.

No, you won’t become a Billionaire by buying Life Insurance.

No, Life Insurance wasn’t a determining factor in the Rockefeller dynasty’s remaining fortune today.

- 99% of dynasty wealth came from Standard Oil

- Then from 140 years of holding blue-chip stocks and compounding did the rest.

- Whole Life Insurance returns are 1-4%.

Yes, the PYGOD Bank concept is inspired by the dynasty Family Bank like the Rockfellers, Rothschilds, etc.

However, unlike most Family Offices, I don’t need a bunch of full-time overpaid parasites (CFO, lawyers, accountants, etc) to run it.

Family Banks vs Companies

Rockefeller-style and Rothschild-style Family Banks are the strongest financial entities ever created.

And here’s why:

🦁 1. Companies Die. Family Banks Don’t.

Even the largest companies on Earth eventually get:

- disrupted

- outcompeted

- regulated

- replaced

- innovated around

- Examples:

- GE fell

- IBM fell

- Nokia fell

- BlackBerry fell

- Sears died

- Kodak died

- Oil giants fluctuate

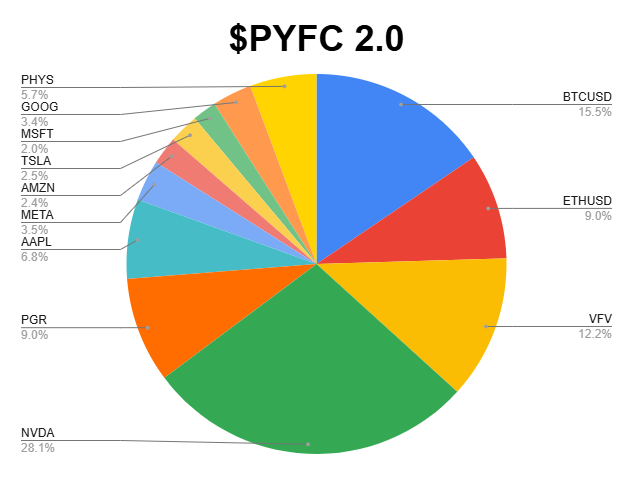

- Even today’s stars (Meta, Google, Apple, Nvidia) could be disrupted someday. That’s the reason why $PYFC 2.0 is also invested in Gold and the broad S&P500 Index.

No corporation is immortal.

But a Family Bank?

- It doesn’t sell one product

- It doesn’t depend on a single market

- It doesn’t rely on innovation cycles

- It can change direction instantly

- It can own ANY asset class, anywhere

A family bank is not a business.

It is an architecture of wealth.

🏦 2. A family bank can survive ANY economic cycle

- Recessions

- Depressions

- Hyperinflation

- War

- Regime change

- Tech shifts

- Market crashes

- Industry death

Family banks survive because:

- They hold diversified assets

- They lend instead of consume

- They NEVER sell in panic

- They don’t have shareholders demanding returns

- They think in 100-year time frames

The Rothschilds survived:

- The fall of Napoleon

- The Crimean War

- World War I

- World War II

- The Great Depression

- Multiple fiat currency collapses

- Regime changes in Europe

No corporate entity has EVER survived that level of destruction.

But their family bank did.

💎 3. Family banks do not depend on external capital

Corporations require:

- customers

- innovation

- product-market fit

- revenue

- investor confidence

- access to credit

Family banks require:

- discipline

- capital preservation

- compounding

- internal lending

VERY different foundations.

A family bank cannot “fail” unless the family:

- destroys it

- empties it

- abandons discipline

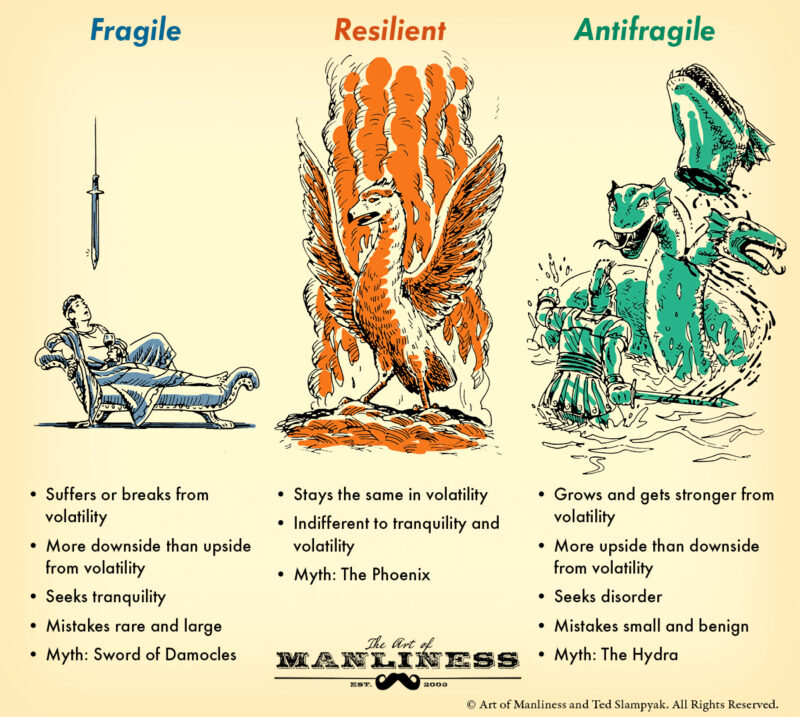

It is antifragile by design.

🔥 4. A family bank can OWN companies, but companies cannot OWN a family bank

Rockefeller Family Bank → owned:

- Standard Oil

- real estate

- railroads

- banks

- oil pipelines

- global assets

- later tech stocks

But Standard Oil could NOT own the Rockefeller bank.

The bank sits ABOVE the economy.

Companies sit inside the economy.

That is why the hierarchy is:

Family Bank > Companies > Markets

🧬 5. Family banks are multi-generational capital machines

A company’s lifespan is typically:

- 10–50 years strong

- then plateau

- then decline

A dynasty bank’s lifespan?

Unlimited, as long as the rules are respected.

Examples:

- Rothschilds: 7 generations

- Rockefellers: 6 generations

- Mellons: 6 generations

- Waltons: now 3 generations and rising

Meanwhile…

The average U.S. corporation lasts 18 years.

🧠 6. They compound without extracting value

Companies must:

- pay dividends

- reinvest profit

- satisfy shareholders

- manage layoffs

- survive competition

Family banks:

- NEVER drain capital

- NEVER have external shareholders

- NEVER face disruption

- ALWAYS compound

They become Sovereign Financial Ecosystems.

👑 FINAL CONCLUSION

✔ YES — family banks are the strongest financial entities ever created.

✔ Stronger than companies.

✔ Stronger than corporations.

✔ Stronger than empires.

✔ Stronger than most nation-states.

Because:

- Companies survive markets.

- Family banks survive centuries.

A company is mortal.

A family bank is immortal — as long as the family follows the rules.

Mine is a conceptual Bank fueled by self-discipline, an Obsession for Money, and a quest for Financial Independence. Since MONEY is Freedom and Security. Two of the most valuable things in life!

PYGOD Bank Goals:

- Wealth Building

- Wealth Preservation

- Financial Independence

- Antifragile.

PYGOD Bank Guidelines:

- Monthly contribution of $1 for each year of your age, or 10% of your profits, or 50% of expendable income—whichever amount is greater.

- 1% Consumption Tax paid to PYB on every non-business dollar spent.

- Can borrow up to 90% of The Vault at 5% interest. You must continue to contribute while paying back your loan monthly.

- Your loan(s) must not be more than what you make in 3 months.

- Never touch the principal ($PYFC 2.0).

- Rules can be amended.

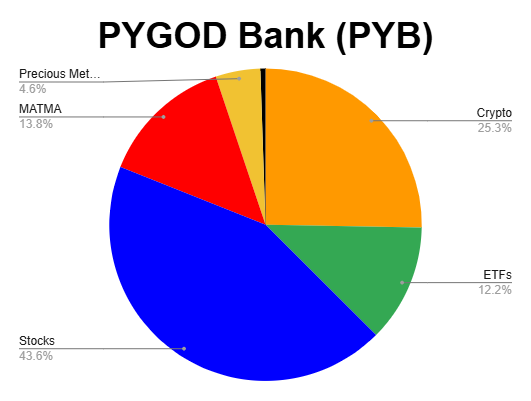

PYGOD Bank has three parts:

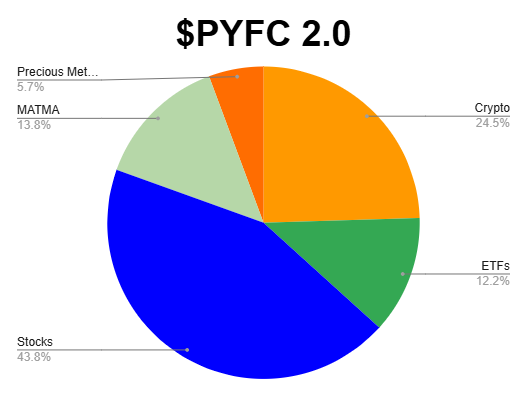

- $PYFC 2.0 (Investments) ⁓ 80%

- The Vault (Saving & Loaning) ⁓ 20% (6-24 months of expenses)

- Freedom Fund (Dividend Redemption Fund, DRF)

PYGOD Bank can have multiple accounts just a bank has multiple branches.

TITHE TO YOURSELF

- Monthly contribution of $1 for each year of your age (great for children), or 10% of your profits, or 50% of expendable income (remaining after living expenses)—whichever amount is greater.

- 1% Consumption Tax paid to PYB on every non-business dollar spent.

- You can tithe in advance.

- You should always tithe/contribute even when in debt.

BORROWING FROM YOURSELF

The Vault (Emergency Corpus)

Goal: Maintain 6 to 24 months of living expenses available for borrowing if necessary. 12 months is the goal, but don’t stop until you hit at least 6.

- Only use it in absolute necessity.

- Can borrow up to 90% of The Vault at 5% interest. You must continue to contribute while paying back your loan monthly.

- Your loan(s) must not be more than what you make in 3 months.

- Rules can be amended.

5% year interest (compound daily) = Monthly Interest: 0.4166666%/month (x 0.0041666)

Calculated Monthly on the Last Day of the Month

Compound Daily (365) 5%/365 = 0.0136986% (x 0.0001369)

Weekly: 0.0961538% (0.000961538)

Minimum Monthly Payment

2% of the balance or $50 if the 2% of the total amount you owe is less than $50.

PYGOD BANK BALANCE SHEET:

ASSETS

- $PYFC 2.0

- The Vault

- Loan to PYGOD

- Dividend Redemption Fund (DRF)

DIVIDEND (The 3% Rule)

Freedom Fund (Dividend Redemption Fund, DRF)

- May withdraw a maximum of 3% of its market value each year on August 30, only if necessary.

- Never touch the principal.

- PYB will calculate its Percent-of-Market-Value (POMV) payout on that date.

- The amount will be 3% of the total PYB value as of August 30 of each year.

- That 3% goes directly into the Freedom Fund.

- Capital allocated to the Freedom Fund may be spent or reinvested within the Freedom Fund.

- Principal (PYFC + The Vault) remains completely untouched.

END GOAL

Live off the 3% yearly dividend and never have to worry about Money ever again. 😎

≤ 5% is a little ≥ 15% is a lot

Black is for Cash (Updated 2025-12-09)

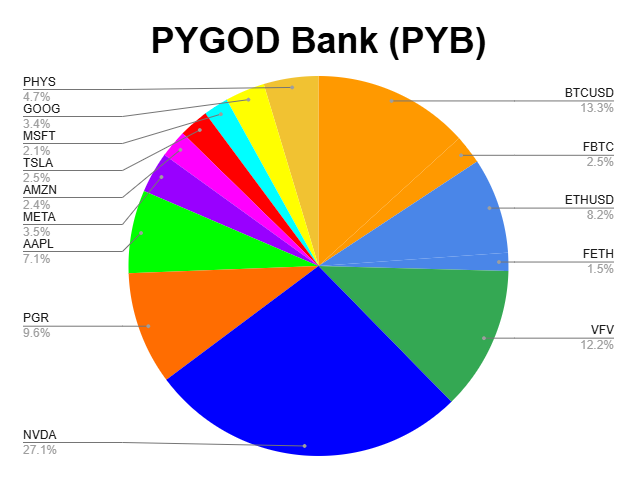

The strength of PYGOD Bank comes from $PYFC 2.0 — a powerful growth engine accounting for 80% of the PYGOD Bank’s capital.

$PYFC (PYGOD Freedom Conglomerate)

PYGOD, Investor/SCA at $PYFC

(Supreme Capital Allocator)

pygod@pygear.com

PYFC.ca

A Foundation, a Collection, a Sovereign Wealth Fund, a Conglomerate, a Currency, and ‘The Secret’ all mixed into one.

One Vehicule: Stock Market (cryptocurrency was an “happy accident” that turned $PYFC into $PYFC 2.0)

Only a few stocks. Only the best.

Only one formula:

Punch Card x Coffee Can

20 Punch Card Portfolio:

“I always tell students in business school they’d be better off when they got out of business school to have a punch card with 20 punches on it. And every time they made an investment decision, they used up one of their punches, because they aren’t going to get 20 great ideas in their lifetime. They’re going to get five or three or seven, and you can get rich off five or three or seven. But what you can’t get rich doing is trying to get one every day.” – Warren Buffett

You have 20 slots (1 investment per slot) for the rest of your life. Choose wisely and carefully.

“The Coffee Can Portfolio harkens back to the Old West, when people put their valuable possessions in a coffee can and kept it under the mattress. The coffee can involved no transaction costs, administration costs, or any other costs. The success of the program depended entirely on the wisdom and foresight used to select the objects to be placed in the coffee can to begin with.” – Robert G. Kirby

In other words, you buy stocks with an investment horizon of at least 10 years and you never sell no matter what. Forget every conventional “wisdom” about diversification and overexposure to a given company or industry. Don’t ever try to time the market. Just HODL (Hold On for Dear Life). The portfolio is not optmized for short-term gains.

Think on a 10-, 20-, and 50-year horizon.

3 measuring sticks:

- AUM (Asset Under Management)

- IC (Invested Capital)

- ROI (Return On Investment)

Goals:

- Capital preservation.

- Long term growth.

6 Pillars:

- PGR

- NVDA (Formerly the “N” in MATMAN)

- AAPL

- VFV.TO

- MATMA

N(META, AMZN, TSLA, MSFT, GOOG) ecosystem “ETF” - PHYS.TO

2 “Happy Accidents”:

- BTC

- ETH

Not a part of $PYFC 2.0

The perfect vehicule to park cash in The Vault

- TCSH.TO

Each stock is bought as a share in a business (as it is).

![]()

PGR (Progressive Insurance) The very best, used to be the backbone of $PYFC 2.0.

NVDA (Nvidia) Certainly the leader of the pack in the AI boom since NVDA is selling the pickaxes and shovels.

AAPL (Apple Computer) Enough said!

It’s probably the best business I know in the world.

— Warren Buffett about Apple

MATMAN (META, AMZN, TSLA, MSFT, GOOG) ecosystem “ETF” that I’ve created. 5 of The Magnificent 7, the two other NVDA and AAPL are just above. Since none of them were and are a particular favorite of mine. But as a unit, they make a lot of sense. NVDA was an official member (MATMAN at the time) before flying solo and becoming my new darling. One thing for sure, tech will always goes up on the long term.

VFV.TO (Vanguard S&P 500 Index ETF – Canadian version) Forget about gold, bonds, and real estate. Historically, the S&P 500 (American economy) has outperformed any other assets. My default investment.

Now you own a piece of the 500 largest publicly traded companies in the United States of America and every fucking stiff from the factory floor to the CEO is working to make you richer.

— The Position Of Fuck You by JL Collins

PHYS (Sprott Physical Gold Trust) Buying physical gold without the hefty premiums to pay on buying and selling it. The best of both worlds!

After selling some of my gold jewelry, I’ve changed my mind about gold as an investment. All I can tell you is that my bling-bling — despite the high premiums on buying and selling jewelry — ended up being one of my best investments, decades later.

I see Gold as a default investment just like VFV (S&P 500 Index ETF). A safe investment to fall back on when/if the AI bubble bursts and some of the Magnificent 7 companies get disrupted.

Money isn’t everything – gold is. Fuck T-bills! Fuck blue chip stocks! Fuck junk bonds! We’ve got the real deal! Money will always be paper, but gold will always be GOLD!

— Darwin Mayflower in Hudson Hawk (1991)

Here’s my two illegitimate bastards below. “Happy accidents” is what I like to call them. I see both as nothing more than glorified lottery tickets. But I like them anyway! Maybe they will be of some use one day.

BTC (Bitcoin) The undisputed King of cryptocurrency.

ETH (Ethereum) The distant number 2.

Apart from those two, the others are worthless shitcoins used for gambling purpose only.

TCSH.TO – TD Cash Management ETF

Following extensive research and analysis — as with everything on this list — TCSH is the best way to park cash in The Vault. Cash that remains available for personal loans when needed. With a safe 3%+ yield, TCSH has already beaten every alternative.

You get up two and a half million dollars, any asshole in the world knows what to do: you get a house with a 25 year roof, an indestructible Jap-economy shitbox, you put the rest into the system at three to five percent to pay your taxes and that’s your base, get me? That’s your fortress of fucking solitude.

— Jim Bennett in The Gambler (2014)

≤ 5% is a little ≥ 15% is a lot

Updated 2026-01-05

Fund Managed: 1

Founded: March 16, 2022 (Bitcoin); June 3, 2022 (Stock Market).

Investing Assets: Stocks, ETFs, Cryptos, Precious Metals

Investment Style: DCA x HODL/CONCENTRATION = $PYFC

Sector: Equity (Long)

Geography: United States

Time: Forever

Investment Stage: Late (Mature Companies)

Strategy: DCA x HODL/CONCENTRATION = $PYFC

# of Holdings: 11

The very best investment vehicule ever created. So great, it’s should be its own currency!

I’ve created it!

Now that you know The Secret, a well-deserved donation to $PYFC 2.0 would be more than appreciate.

[button text=”DONATE” color=”success” link=”https://paypal.me/PYFC2″ target=”_blank”]

Now, all you got to do is to fund it.

Feed the Bank!!!

Everything of the above, just like anything worthwhile in life, is only possible with one thing.

DISCIPLINE

POD: The 40% Rule

Licensing /Royalties / Passive Income Is The Sweetest MONEY You Can Get.

— PYGOD

My main, time-tested business is POD (Print-On-Demand): running online marketplace accounts that collect royalties from products sold with my designs on them.

The 40% Rule:

Average Monthly Net Profits (last 12 months) × 30 = POD Account(s) Value

2.5 years of profit is the conservative value for a POD account. Which represents a 40% annual return on investment.

POD accounts are usually sold at a 40× multiple, so a 30× multiple is a very conservative estimate of what will actually remain in your pocket after broker fees and other transaction costs.

As I like to say: It’s the sweetest Money you can get.

- Passive Income

- Nothing to do

- No operating fees, usually

- No marketing

- No customer service

- No acquisition cost

- No inventory

All you have to do is a huge quantity of T-shirt designs to start your business. It’s a number game. A lot of repetitive work is required at the beginning, including designing, upscaling, and uploading. To make this business successful, you’ll need thousands of designs published on several online platforms. You’ll also need a lot of patience, since the results don’t come fast.

There are risks. Platforms can change their algorithms, reduce creators’ royalties, limit the number of designs you can publish, or even ban your account. Their house, their rules.

Now, I challenge you to find any investment—real estate, stocks, crypto, or otherwise—that can deliver a 40% annual return on investment on a regular basis.

MONEY Bin

“A million dollars is a great thing. Then you can just put it in the bank, and relax. Sometimes people tell me “I have a million dollars. What should I invest in?” I say don’t invest in anything. That is great, man. Put it in the bank. Just have the cash for awhile. Cash is cool.” – James Altucher

“I like money on the wall. Say you were going to buy a $200,000 painting. I think you should take that money, tie it up, and hang it on the wall. Then when someone visited you the first thing they would see is the money on the wall.” ― The Philosophy of Andy Warhol

Start Over Fund (1 or 2 years of expenses)

Treat it like a Treasure.

You should never touch it. Except in case of a zombie apocalypse.

PYGOD, Banker of PYGOD Bank and Chess Scholar

References:

Family Bank – Start One In 5 Simple Steps

https://www.linkedin.com/pulse/you-can-illuminati-following-three-steps-sudarsan-babu/

https://funcheaporfree.com/the-7-bank-accounts-your-family-should-have-updated/

https://jaserodley.com/why-you-need-a-freedom-fund/

https://www.sentex.ca/~ggrevs/LearnToTitheToYourself.html

https://humbledollar.com/2017/10/self-tithing/

https://rossdawson.com/power-of-giving-away-profits/

https://petikspinayinvestor.wordpress.com/wp-content/uploads/2015/05/the-money-jars-edition-3.pdf

https://www.everydaycheapskate.com/how-to-be-your-own-lender/

https://www.peoplespolicyproject.org/projects/social-wealth-fund/

https://levelthefield.substack.com/p/creating-a-sovereign-wealth-fund

https://sabercapitalmgt.com/practicing-a-punch-card-approach-to-investing/

https://brontecapital.blogspot.com/2016/09/comments-on-investment-philosophy-part.html

https://tdmgrowthpartners.com/insight/punch-card-mentality/

https://kestrel.ie/resource/practicing-a-punch-card-approach-to-investing/

https://sabercapitalmgt.com/the-coffee-can-edge/

https://novelinvestor.com/the-coffee-can-approach/

https://www.intelligentinvestor.com.au/investment-news/till-death-do-us-part-my-never-sell-list/139202

Disclosures:

I am long BTC, ETH, NVDA, PGR, VFV, AAPL, META, GOOG, MSFT, AMZN, TSLA, PHYS, and TCSH.

The content contained in this whitepaper represents the opinions of PYGOD. You should assume PYGOD and his affiliates have positions in the securities discussed in this whitepaper, and such beneficial ownership can create a conflict of interest regarding the objectivity of this whitepaper. Statements and figures in the whitepaper are based on historical data and do not guarantee future performance. Investments in stocks, stock indices, cryptocurrencies and commodities can be volatile and are subject to certain risks, uncertainties and other factors. Certain information in this whitepaper concerning economic trends and performance is based on or derived from information provided by third-party sources. PYGOD does not guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Such information may change after it is posted and PYGOD is not obligated to, and may not, update it. The commentary in this whitepaper in no way constitutes a solicitation of business, an offer of a security or a solicitation to purchase a security, or investment advice. In fact, it should not be relied upon in making investment decisions, ever. It is intended solely for the entertainment of the reader, and the author. In particular this whitepaper is not directed for investment purposes.