Philanthropy… What a beautiful word.

Especially when it can serve your own interest (lowering your tax bill, influence with your donation, good for PR too 😜)

What about creating your own Foundation? A foundation to serve your own interests, of course.

Sounds interesting, isn’t it?

Tithing to God?!

Tithing to church??

Tithing to Kenneth Copeland? So he can buy a brand new jet. All in the name of God.

God’s MONEY???

Adoration?

Why not tithing to yourself instead?

After all, you are your own God.

FOUNDATIONa: funds given for the permanent support of an institution (YOU) : ENDOWMENTb: an organization or institution established by endowment with provision for future maintenance (of yourself).

ENDOWMENT

Endowments are often structured so that the inflation-adjusted principal or “corpus” value is kept intact, while a portion of the fund can be (and in some cases must be) spent each year, utilizing a prudent spending policy. Wiki

Financial endowments, sums of money that are invested in stocks, yielding returns that fund a portion of an institution’s operational expenses (Yours) and help ensure that it survives in perpetuity. i.e. Financial Independence + Financial Resilience.

Both make perfect sense.

36% of Americans say they can’t cover a $400 emergency.

Murphy’s Law AKA Shit Happens: When you lose your job, your fridge will break.

As I’m writing this, Princesse, my beloved dog, lost a tooth while playing. Damn! A vet’s bill to come.

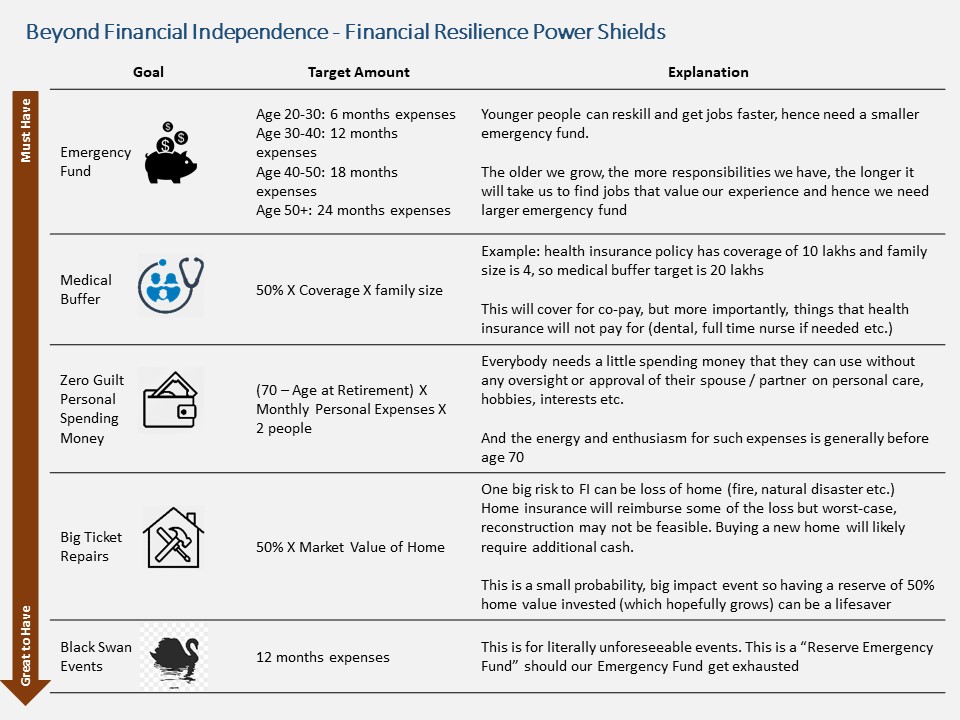

Emergency Fund

Conventional wisdom…

The rule of thumb is to have 3-8 months of living expenses set aside.

Job loss, car accident, health problem,

The YOU Foundation

Charity to Yourself. Slush fund.

- 6 months to 1 year of living expenses.

FUNDING:

- Tithing 10% to yourself on EVERY pennies that you earn, find, steal, etc.

MISSIONS:

- Money saved for non-monthly and irregular expenses. Emergency.

- Setback.

- Instead of using credit or borrowing money.

- Investing.

- Tax-break.

3 requirements to use your Emergency Fund?

- Unexpected

- Necessary

- Urgent

Your Emergency Fund must be:

- Liquid

- Easily accessible

- No risk of loss. Diversity and security.

- Cash Money. Paper bills and coins. Always useful no matter what!

- Online bank account or PayPal account. Mandatory since many of our bills and expenses are online.

- Short-term CDs or money market deposits. Trying to snatch a few percent of interest on your Money.

- ETFs and stocks.

Here is a chart of a Emergency Fund Portfolio allocation

- 60% in Liquid Investments

- 20% in a Saving Bank Account

- 20% in Cash

Some financial “experts” suggest between 30%-50% invested in stocks and ETFs. A 40% investment of your Foundation in stocks and/or ETFs makes sense.

Sorry to all my prepper’s friends, no precious metals and cryptocurrencies are required here.

What’s the difference between the YOU Foundation and YOU Bank?

You CAN’T touch to the YOU Bank unless it’s a literal life-or-death situation. Nothing less…

Act as if the YOU Bank doesn’t exist. It’s just a pleasant number that you can see weekly on a piece of paper or your computer screen.

That’s the reason why the YOU Foundation is a necessity. You may think you’ll never had to ever touch it. But shit happens. You can lose a major stream of income or even two, just like I did.

Having Money sets aside in those dire moments is so comforting, even comfortable I should say.

Layers Of Shit

1- Buffer. An operating fund enough to cover the next 30 days to 3 months of mandatory expenses and to keep the minimum balance ($100) in bank accounts.

- Cash on hand.

- Bank accounts.

- PayPal accounts.

2- Emergency Fund. 6 to 12 months of living expenses, taxes, insurances, permits, fees, subscriptions X 1.3.

- 30% cash

- 30% bank account

- 40% invested in the stock market

Your expenses plus 30% to counter any stock market crash since 40% of your EF is invested in the stock market.

3- SHTF/GTFO Fund. $2517.00 in cash and a debit card.

- 20 x $100

- 4 x $50

- 12 x $20

- 4 x $10

- 4 x $5

- 5 x $2

- 5 x $1

- 5 x 25¢

- 5 x 10¢

- 5 x 5¢

4- Freedom Fund. Financial Independence = 25X-33X annual expenses. Living off the fund’s interest. The FIRE Movement 4% rule or 3% in the later case.

- $2.5 Million invested in conservation stocks and ETFs since, ideally, you will off your Money’s interest. A cool number as mentioned in The Gambler movie. Maybe more than 25 X your yearly expenses. But the more the better.

- Your paid house. A liability? I don’t give a fuck! It still better than being a renter.

- And all of the above.

5- Start Over Fund. 1 to 2 years of expenses in cash.

That’s what I call Fuck You MONEY!!

Jim Bennett: I’ve been up two and a half million.

Frank: What you got on you?

Jim Bennett: Nothing.

Frank: What you put away?

Jim Bennett: Nothing.

Frank: You get up two and a half million dollars, any asshole in the world knows what to do: you get a house with a 25 year roof, an indestructible Jap-economy shitbox, you put the rest into the system at three to five percent to pay your taxes and that’s your base, get me? That’s your fortress of fucking solitude. That puts you, for the rest of your life, at a level of fuck you. Somebody wants you to do something, fuck you. Boss pisses you off, fuck you! Own your house. Have a couple bucks in the bank. Don’t drink. That’s all I have to say to anybody on any social level. Did your grandfather take risks?

Jim Bennett: Yes.

Frank: I guarantee he did it from a position of fuck you. A wise man’s life is based around fuck you. The United States of America is based on fuck you. You have a navy? Greatest army in the history of mankind? Fuck you! Blow me. We’ll fuck it up ourselves.The Gambler (1996).

Now that you have the setups and financial goals for The YOU Foundation. What about collecting fund in a jar? So people who visit your place might feel obligate to donate some spare change to your Foundation. 😉

ENDING ON A SOUR NOTE.

You must pay all your debts before setting up your Foundation. 🤣

So, you will have to pay the tithe to your creditors. Still more worthwhile than god or… Kenneth Copeland!

Health & Wealth

PYGOD

SUBSCRIBE

Sources and related links:

https://www.sentex.ca/~ggrevs/LearnToTitheToYourself.html

https://humbledollar.com/2017/10/self-tithing/

https://jotofi.com/tithe-yourself-now/

https://mymoneywizard.com/emergency-fund-like-a-pro/

https://www.ninjapiggy.com/blog/5-steps-to-an-emergency-fund-infographic

https://innovativewealth.com/financial-planning/your-emergency-fund-understanding-the-importance-of-cash/

https://walletsquirrel.com/emergency-fund/

https://barbarafriedbergpersonalfinance.com/do-billionaires-need-emergency-fund/

https://funcheaporfree.com/the-7-bank-accounts-your-family-should-have-updated/

https://finmonkey.in/emergency-fund/

https://mobile.twitter.com/LifeAfterFI/status/1404316485502132226

https://www.cnbc.com/2015/10/01/how-to-invest-yes-invest-your-emergency-fund.html

http://www.financialtipoftheday.com/financial-tip-of-the-day/why-25-million-is-the-perfect-level-of-fuck-you-money#/

https://www.flaneurlife.com/fck-you-money/

https://www.billionairegambler.com/2016/10/cash-is-still-king-even-for-survivalists.html